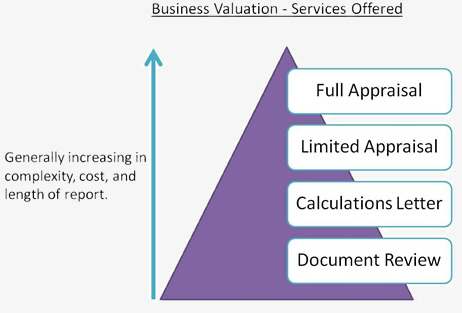

Customizable Services

Scope

Calculations Letter

We are often hired by business owners to conduct a Calculations Letter for business planning purposes, or parties to a marital dissolution for mediation, or for settlement when the parties are working on an amicable settlement.

A Calculations Letter typically costs about half the price of a Full Appraisal because it does not include the extensive written report. In addition, unlike a Full Appraisal, it is only an estimate of value.

We typically do not recommend a Calculations Letter for shareholder disputes or litigation purposes, or for the IRS (estate planning, gift tax reporting or stock compensation reporting).

Download Sample Calculations Letter.

Limited Appraisal

The objective of a Limited Appraisal is to express an estimate of the value of a business, business ownership interest, security or intangible asset. The development of this estimate excludes additional procedures that are required in a Full Appraisal.

A Limited Appraisal is the format required by SBA Bank Lending. However, there may be other occasions where this format is requested by a client who wants a deeper analysis than a Calculations Letter without incurring the cost of a Full Appraisal.

A Limited Appraisal might also be appropriate in certain unique situations, such as:

- If the company had previously experienced financial mismanagement causing uncertainty as to whether or not historical results were reliable.

- If the company were undergoing a managerial transition period, during which it was difficult for management to project future operating results.

The fees for a Limited Appraisal are typically more than a Calculations Letter and less than a Full Appraisal.

Full Appraisal

A Full Appraisal is an extensive written narrative report, followed by financial schedules that present a definitive value conclusion.

A Full Appraisal report can range between 30 to 80 pages, depending on the complexity of the company. In addition to providing a definitive valuation conclusion, it will contain historical information about the company, a current economic and industry analysis, a description of the company’s financial condition, discussion of appropriate valuation methods, and a detailed explanation of the valuation models and assumptions used.

A Full Appraisal meets the Uniform Standard for Professional Appraisal Practice (USPAP) professional reporting standards to be called an “appraisal”.

Please contact us for a sample full appraisal report.

Expert Testimony

We are most often hired as an expert in business valuation for shareholder disputes and marital dissolution. We have also prepared business valuation analysis for expert testimony in bankruptcy, for charitable organizations harmed based on the actions of the board, as a result of a management buyout that was conducted without full disclosure to the other shareholders, and other situations.

We also provide expert testimony services for financial damages (ie lost business value, lost earnings).

Fees for expert testimony are charged at agreed hourly rates for preparation time and testimony.

Cost

Cost varies depending on a variety of factors:

- Company size

- Complexity of capital structure

Financial Damages

- Lost Profits

- Lost Business Value

- Lost Wages

Types of appraisals conducted by our team

-

- S Corporation

- C Corporation

- Limited Liability Company

- Partnership

- Joint Venture

- Operating Company

- Over 1,000 appraisals in a wide spectrum of industries, including professional services, financial services, automobile dealerships, construction, manufacturing, retail, wholesale and distribution.

- Asset Holding Companies (real estate holding companies, marketable securities holding companies and other companies that hold mainly assets with little or no operations).

- 100% Controlling Valuation of Equity

- Total Capital Valuation

- Value of thinly traded OTC shares

- Minority Ownership

- Non-Voting Shares

- Fractional Interest in Real Estate Valuation

- Preferred Stock Valuation

- Determination of value for warrants and options

Examples

Purpose |

Examples |

|||||||||

| Litigation | A company was sold but the selling shareholder provided false information to the buyer. A valuation is needed to determine the true value of the company at the time of sale. | |||||||||

| Shareholder Dispute | Two shareholders own a business together and need assistance in determining a fair value for the departing shareholder. | |||||||||

| Estate Tax Reporting | Upon death, the decedent owned a minority ownership in a company. An appraisal is needed to determine the amount of estate tax owed at the state and federal level. | |||||||||

| Gifting | A father wants to gift a minority ownership in his company to his sons. A valuation is needed to determine the value of the gift. | |||||||||

| Divorce | A wife owns a business. In order to finalize her divorce, the value of the company is needed for settlement and equitable distribution of the assets. | |||||||||

| Business Planning | A business owner is trying to decide whether to sell his company to a third party or sell 10% ownership to a key employee. A valuation will give him an understanding of the value of his company and help him decide what course to take. | |||||||||

| S Corporation Election | A valuation is needed at the time that a C Corporation makes a S Corporation election to set the basis in the assets. | |||||||||

| Sale | A valuation is needed to determine the value at the time of sale of a company. A business owner may consider hiring a business broker, but a credentialed business appraiser is obligated to provide an independent value conclusion. | |||||||||

| Bankruptcy | A business owner sold his company in exchange for shares in a company that filed for bankruptcy within months of the sale. A business valuation was required to prove to the IRS that the shares issued to the seller were worthless at the time of sale and that no taxes were owed. | |||||||||

| Bank Financing | A business valuation is needed to determine the value of a company in order to obtain financing. | |||||||||

| Private Party Note Valuations | An individual made several loans to a private party. At his death, the notes had not been repaid and had a poor payment history. It was unlikely that the notes were fully collectible. An appraisal was needed for estate tax reporting purposes to support that the value of the notes was less than face value. | |||||||||

| Fractional Interest in Real Estate Valuation | An individual owns a 50% interest in real property (also called a fractional or a partial interest). The interest could be any real property holding, whether a farm, an apartment building, a home, or any other real estate holding. It is generally accepted that a partial interest in real estate is less valuable than 100% ownership and an appraisal is used to document the value for estate tax reporting purposes. | |||||||||